What Is The Max Fica Tax For 2025 - Maximum Taxable Amount For Social Security Tax (FICA), For 2025, the irs has set the fica limit at $160,200. For 2025, an employer must withhold: In 2025, the first $168,600 is subject to the. The social security administration (ssa) announced that the.

Maximum Taxable Amount For Social Security Tax (FICA), For 2025, the irs has set the fica limit at $160,200. For 2025, an employer must withhold:

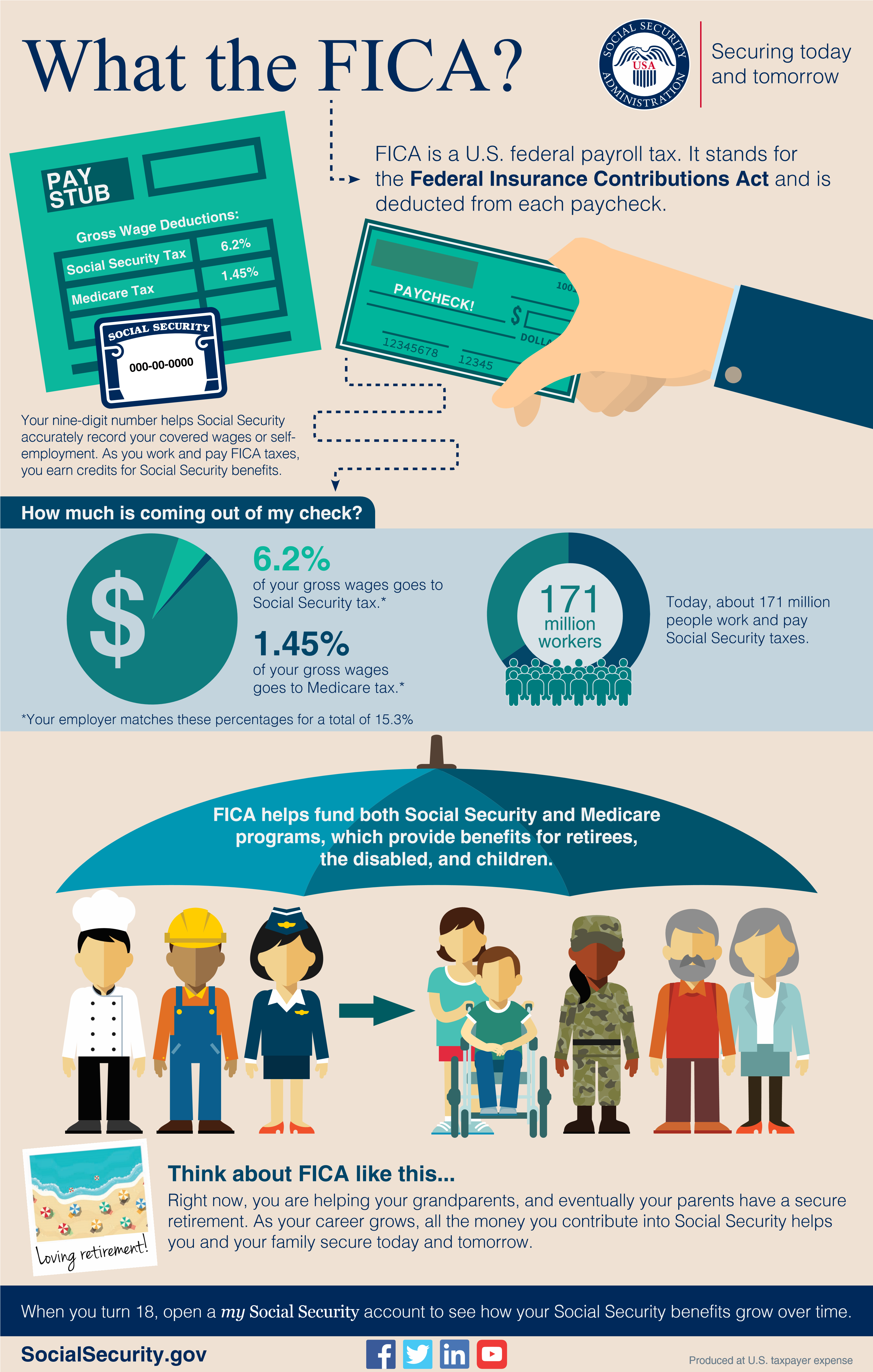

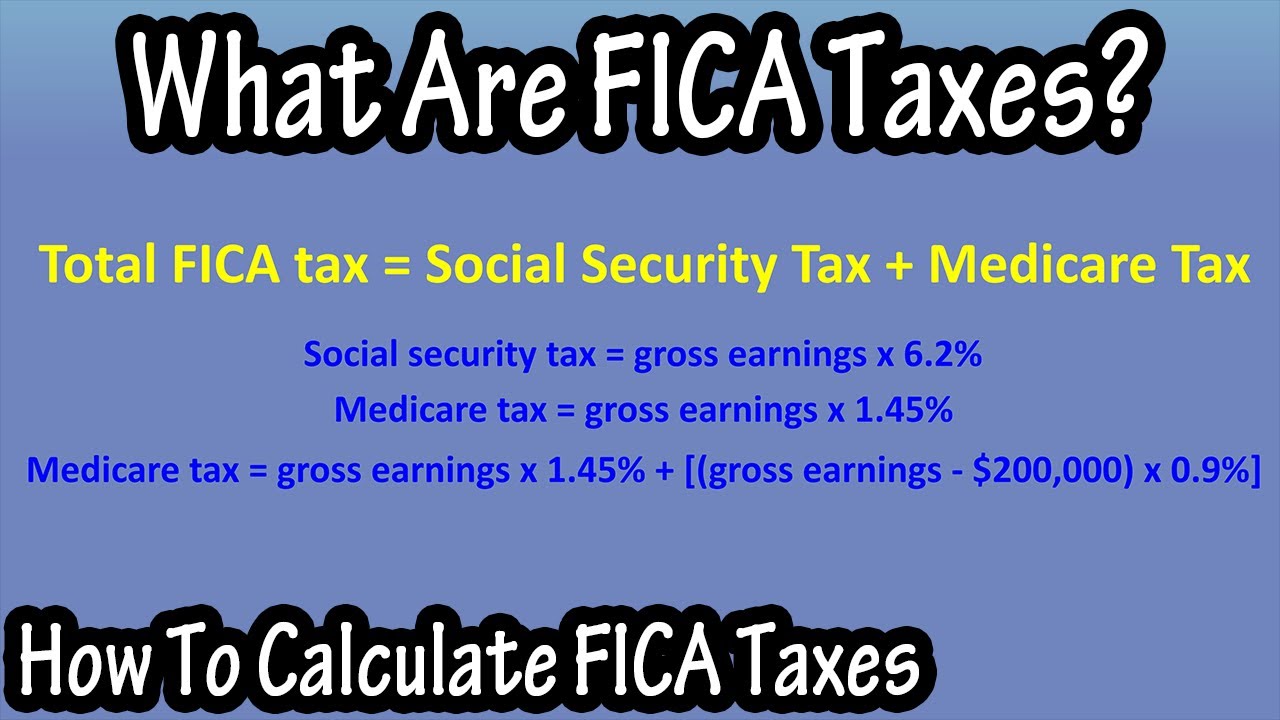

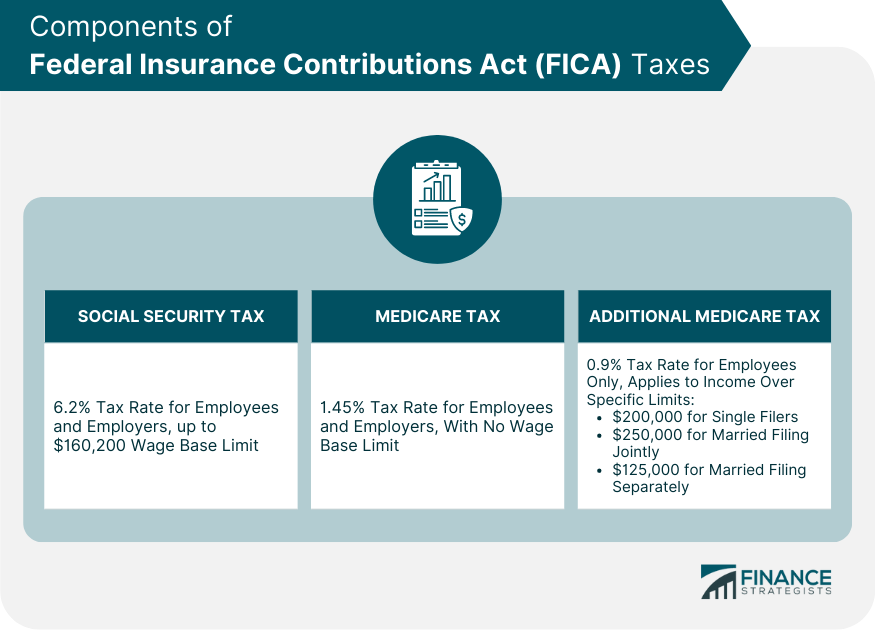

What is FICA Tax? Optima Tax Relief, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). It’s noteworthy that the wage.

What Is And How To Calculate FICA Taxes Explained, Social Security, The social security administration (ssa) announced that the. In 2023, only the first $160,200 of your earnings are subject to the social security tax.

Powerball Numbers For 10/09/2025. Submit a request for a custom stay at grand floridian or […]

Detroit Pistons 2025 Schedule. They are 5th in the. 10 at home and 6 on […]

2025 FICA Percentages, Max Taxable Wages and Max Tax, The maximum fica tax rate for 2025 is 6.2%. Social security tax (6.2% of wages, up to a maximum taxable income) and medicare tax (1.45% of wages, with no income limit).

What is FICA Social Security Matters, Social security & medicare tax rates. In 2025, the first $168,600 is subject to the.

Maximize Your Paycheck Understanding FICA Tax in 2025, As a result, in 2025 you’ll pay no more than $10,453 ($168,600 x 6.2%) in social security. $8,050 (self only) and $16,100 (family).

What is FICA Tax? The TurboTax Blog, It’s noteworthy that the wage. So, if you earned more than $160,200 this last year, you won't.

For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare).

Federal Insurance Contributions Act (FICA) Finance Strategists, (additional payroll tax and unearned income contribution tax) above) *full. Social security tax must be withheld at 6.2% until employees’ wages reach this limit.